Products Center

Products Center

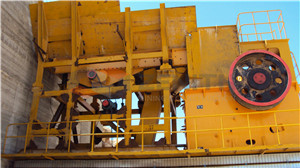

Stone Crusher

Stone Crusher

Grinding Mill

Grinding Mill

Optional Equipment

Optional Equipment

Mobile Crusher

Mobile Crusher

Knowledge Hall

Knowledge Hall

Crushers FAQ

Crushers FAQ

Grinding Mills FAQ

Grinding Mills FAQ

Mining Equipments

Mining Equipments

Solution

Solution

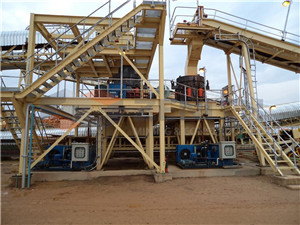

Stone Crushing

Stone Crushing

Sand Making

Sand Making

Ore Processing

Ore Processing

Grinding Plant

Grinding Plant

Construction Building Material

Construction Building Material

mining aggregate royalty rates

Corporate income taxes, mining royalties and other mining ...

Global mining industry update June 2012 Corporate income taxes, mining royalties and other mining taxes A summary of rates and rules in selected countries

Areva reaches uranium mining deal with Niger, …

French nuclear engineering group Areva SA said Monday it has reached a deal with Niger's government to continue uranium mining as it pledged to pay more taxes and to ...

Mining News, Mining Companies & Market …

Mining news and commentary from around the globe. Daily updates on gold and commodity prices, exploration, mine development and mining company activities.

Royalty rates - NSW Resources and Energy

A mineral royalty is the price charged by the Crown for the transfer of the right to extract a mineral resource. The price (royalty rate) is prescribed in legislation.

Royalty Rates for Licensing Intellectual Property

2014-4-28 · Royalty Rates for Licensing Intellectual Property Document Transcript. Royalty Rates for Licensing Intellectual Property Royalty Rates for ...

Data mining - Wikipedia, the free encyclopedia

Data mining (the analysis step of the "Knowledge Discovery in Databases" process, or KDD), an interdisciplinary subfield of computer science is the computational ...

The Northern Miner - Global Mining News

Mining news, analysis and property database of mineral explorers and producing miners listed on Canadian and U.S. stock exchanges.

Royalties - Wikipedia, the free encyclopedia

A royalty (sometimes, running royalties, or private sector taxes) is a usage-based payment made by one party (the "licensee") to another (the "licensor") for the ...

Mining Plant List - ZENTIH crusher for sale used in …

Mining Plant List. working proces of cone crushing plant; working in sudan on cement plant; where in acc aggrigate plant; what should be the aggregate value of plant ...

Mining Royalties - ISBN: 0821365029 - World Bank Group

Mining Royalties A Global Study of Their Impact on Investors, Government, and Civil Society James Otto Craig Andrews Fred Cawood Michael Doggett Pietro Guj

State/Provincial Mining Taxes for U.S. and Canada …

The most significant state taxes applicable to the U.S. mining industry can be loosely categorized as follows: corporate income taxes ; property taxes

Royalty Tax – Discover Taxes & Rates on Oil & Gas …

Explains common royalty taxes and how these relate to mineral rights and royalty owners. Links to more detailed articles relating to taxes on royalties.

Republic of Mining

Republic of Mining - Republic of Mining ... The Globe and Mail is Canada’s national newspaper with the second largest broadsheet circulation in the country.

Mineral Rights | Oil & Gas Lease and Royalty …

A detailed explanation of mineral rights applied to coal, stone, metals, oil and natural gas by Geology

Glossary of Mining Terms - Coal Education

A. Abutment - In coal mining, (1) the weight of the rocks above a narrow roadway is transferred to the solid coal along the sides, which act as abutments of the arch ...

Royalty Agreement, Royalty Agreement …

These example Royalty Agreement are actual legal documents drafted by top law firms for their clients. Use them as Royalty Agreement samples, Royalty Agreement ...

Chapter 32: MINING POLICY - Guyana

I. Basic Features of the Sector [Back to Top] A. Economic Importance of Mining to Guyana. 1. Production. Mineral prospecting and inventory in Guyana started in 1868 ...

Mining Tax Guide - Minnesota Department of Revenue

Mining Tax Guide SS J. A. Campbell in Taconite Harbor, ca. 1957-1964 (2005.0038.3318), Minnesota State Representative Fred A. Cina Papers, Iron Range Research Center ...

Rates of TDS - Saral TaxOffice

Other Interest > Aggregate sum exceeding Rs. 10,000 for Banking Co's , etc.per person during the financial year. > Aggregate sum exceeding Rs. 5,000 per person during ...

SSESSMENT OF INING ROPERTIES - State Board of Equalization

AH 560 i March 1997 PREFACE This edition of Assessors’ Handbook Section 560, Assessment of Mining Properties, is a complete rewrite of the original manual (entitled ...

Padcal | About Us | Philexmining

The Padcal Mines is under 12 mineral holdings, with an aggregate 95 hectares in Benguet Province, which are subject to royalty agreements with claim owners.

liCGMne quarry, gold mining equipment, used …

Home >> Quarry Machine liCGMne quarry, gold mining equipment, used graphite mining equipment, types of mining in south africa

Mining News | Gila 1019 News

Vancouver based Capstone Mining Corporation told stockholders last week it was looking into a possible new extension of the mine life of its Pinto Valley copper ...

Mining Companies - TMX Group

TSXV MM Issuers April 2014 TSX MM Issuers April 2014 TSX_2012 TSXV_2012 Australia/NZ/PNG Ireland Guernsey Mali Ghana Albania Namibia Pakistan AK,NV NY …

RoyaltySource - Royalty Rate Database & License …

RoyaltySource is a database of the most comprehensive and easy-to-use source of Royalty Rates featuring expert advice. No contract or subscription required.

Polymer Flocculants - Tramfloc, Inc. - Industrial …

Industrial and Mining Chemicals for Water and Wastewater Treatment

State/Provincial Mining Taxes for U.S. and Canada …

The most significant state taxes applicable to the U.S. mining industry can be loosely categorized as follows: corporate income taxes ; property taxes

Royalty Tax – Discover Taxes & Rates on Oil & Gas …

Explains common royalty taxes and how these relate to mineral rights and royalty owners. Links to more detailed articles relating to taxes on royalties.

Republic of Mining

Republic of Mining - Republic of Mining ... The Globe and Mail is Canada’s national newspaper with the second largest broadsheet circulation in the country.

Mineral Rights | Oil & Gas Lease and Royalty …

A detailed explanation of mineral rights applied to coal, stone, metals, oil and natural gas by Geology

Glossary of Mining Terms - Coal Education

A. Abutment - In coal mining, (1) the weight of the rocks above a narrow roadway is transferred to the solid coal along the sides, which act as abutments of the arch ...

Royalty Agreement, Royalty Agreement …

These example Royalty Agreement are actual legal documents drafted by top law firms for their clients. Use them as Royalty Agreement samples, Royalty Agreement ...

Chapter 32: MINING POLICY - Guyana

I. Basic Features of the Sector [Back to Top] A. Economic Importance of Mining to Guyana. 1. Production. Mineral prospecting and inventory in Guyana started in 1868 ...

Mining Tax Guide - Minnesota Department of Revenue

Mining Tax Guide SS J. A. Campbell in Taconite Harbor, ca. 1957-1964 (2005.0038.3318), Minnesota State Representative Fred A. Cina Papers, Iron Range Research Center ...

Rates of TDS - Saral TaxOffice

Other Interest > Aggregate sum exceeding Rs. 10,000 for Banking Co's , etc.per person during the financial year. > Aggregate sum exceeding Rs. 5,000 per person during ...

SSESSMENT OF INING ROPERTIES - State Board of Equalization

AH 560 i March 1997 PREFACE This edition of Assessors’ Handbook Section 560, Assessment of Mining Properties, is a complete rewrite of the original manual (entitled ...

- Last Product: examine the machine to send satellite

- Next Product: what are the raw materials involved in the mining production

RD Equipments

- notification regarding rate of sand aggregate & stone by mining department in himachal pradesh

- personal protective equipment in mine

- madhani talatah nusantara coal mining contractor

- sand mine production numbers

- list of coal mines modern firefighting equipments

- coal mining construction companies

- coal mining for sale

- reliance coal mines in singrauli mp in mumbai, india - basalt crusher

- mining machinery company perak ipoh

- mining companies in south africa johannesburg contact details