Products Center

Products Center

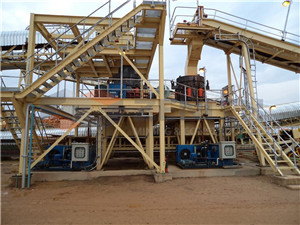

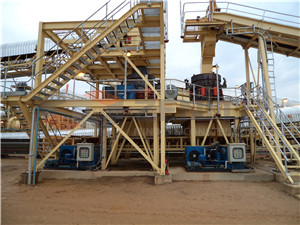

Stone Crusher

Stone Crusher

Grinding Mill

Grinding Mill

Optional Equipment

Optional Equipment

Mobile Crusher

Mobile Crusher

Knowledge Hall

Knowledge Hall

Crushers FAQ

Crushers FAQ

Grinding Mills FAQ

Grinding Mills FAQ

Mining Equipments

Mining Equipments

Solution

Solution

Stone Crushing

Stone Crushing

Sand Making

Sand Making

Ore Processing

Ore Processing

Grinding Plant

Grinding Plant

Construction Building Material

Construction Building Material

tax exemption on mining equipment in ghana

26 U.S. Code § 501 - Exemption from tax on …

An organization exempt from taxation under subsection (a) shall be subject to tax to the extent provided in parts II, III, and VI of this subchapter, but ...

ST-587 Equipment Exemption Certificate - Illinois

ST-587 Equipment Exemption Certificate Instructions General Information When is an Equipment Exemption Certificate required? Generally, an Equipment Exemption ...

TC-721, Utah Sales Tax Exemption Certificate

A sales tax license number is required only where indicated. NOTE TO SELLER: Keep this certificate on file since it must be available for audit review.

Mining in Ghana - Overview - MBendi

A profile of Mining in Ghana with directories of companies, people, industry sectors, projects, facilities, news and events.

Sales tax exemption documents - Department of …

Enter your keyword/search term and then select a tax year, tax, and click "Google Search". To find the correct sales tax return, select the year in which the sales ...

Department of Revenue - Taxation:Sales Tax …

Below is a list of Colorado State Sales Tax Exemptions. Please note: Local Government Exemptions differ from the State Exemptions. Please see the DR 1002 for more ...

How to Claim a Farming Sales Tax Exemption | eHow

How to Claim a Farming Sales Tax Exemption. If you are a farmer or rancher, you are entitled to take advantage of state tax exemptions for various items that you use ...

Indiana - Sales and Use Tax Exemptions and …

Indiana Exemptions and Exemption certifcates ... Indiana - Sales and Use Tax Exemptions and Exemption Certificates: Indiana imposes an excise tax known as the …

Publication 17 (2013), Your Federal Income Tax

How to claim exemptions. How you claim an exemption on your tax return depends on which form you file. If you file Form ...

Organization Status for Your Tax-Exempt - Internal …

Foundations. The determination of the ef-fective date is the same for the revocation or modification of foundation status or operating foundation status unless the ...

Chartered Institute of Taxation, Ghana - Welcome …

You are welcome to Chartered Institute of Taxation (Ghana) Established in 1980 the Chartered Institute of Taxation (Ghana) is the sole professional body mandated by ...

New York State and Local Sales and Use Tax ST-121 Exempt ...

Page 2 of 4 ST-121 (1/11) Part 2 — Services exempt from tax (exempt from all state and local sales and use taxes) Enter Certificate of Authority number here (if ...

Buyers’ Retail Sales Tax Exemption Certificate

REV 27 0032 (7/16/14) 1 BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE Not to be used to make purchases for resale Vendor/Seller Date Street Address City State …

Jobs in Ghana - Ghana Current & Latest Jobs, Job …

Cardno has Accounting job vacancies in Ghana to recruit Accountants. We are a professional infrastructure and environmental services company, with specialist ...

VAT - Ghana Revenue Authority

WHAT IS VAT? Value Added Tax (VAT) is a tax applied on the value added to goods and services at each stage in the production and distribution chain.

About Property Tax - sctax.org

Property Tax Information . How the Tax is Figured . Each class of property is assessed at a ratio unique to that type of property. The assessment ratio is applied to ...

E-595E Streamlined Sales and Use Tax Agreement Web …

Streamlined Sales and Use Tax Agreement Certificate of Exemption: Multistate Supplemental Name of purchaser State Reason for exemption Identification number (if …

GENERAL GUIDELINES FOR THE MANUFACTURING/R&D …

GENERAL GUIDELINES FOR THE MANUFACTURING/R&D PERSONAL PROPERTY TAX EXEMPTION IN MARYLAND Manufacturing/R&D Exemption State law authorizes …

Pennsylvania Exemption Certificate (REV-1220)

check one: pennsylvania tax unit exemption certificate (use for one transaction) pennsylvania tax blanket exemption certificate (use for multiple transactions)

Frequently Asked Questions - Sales Tax Taxability …

Sales Tax Taxability and Exemptions. What is the sales taxability of a leasing agreement? What is a domestic utility sales tax and how is it imposed?

State of Texas Film Sales Tax Exemption - Office of …

IMPORTANT: The information below refers only to Texas sales tax exemptions as applicable to filmmakers and computer and video game developers.

Current Tax Forms : Louisiana Department of …

Louisiana Department of Revenue Official Homepage ... Form Name (sort by title | code) Period Form; R-1009 - Certificate of Exemption for Shipbuilders of Vessels Over ...

Taxation in Iran - Wikipedia, the free encyclopedia

According to the Expediency Council, more than 60% of economic activity in Iran evades taxation: 40% of the economic activity falls under an exemption and the ...

NRS: CHAPTER 361 - PROPERTY TAX - Nevada …

[Rev. 11/21/2013 11:03:37 AM--2013] CHAPTER 361 - PROPERTY TAX. GENERAL PROVISIONS. NRS 361.010 Definitions. NRS 361.013 ...

Sales Tax and Use Tax Exemptions - Georgia …

Sales tax and use tax exemptions for Georgia companies offset purchases, upgrades and replacement of equipment, including machinery in warehouses and distribution ...

Use tax - Wikipedia, the free encyclopedia

A use tax is a type of excise tax levied in the United States by numerous state governments. It is assessed upon tangible personal property purchased by a resident …

Malaysian Tax Guide 2008 - Scribd

2007/2008. Malaysian Tax and Business Booklet PP13148/7/2008 2007/2008 MALAYSIAN TAX AND BUSINESS BOOKLET A quick reference guide outlining Malaysian tax …

Chartered Institute of Taxation, Ghana - Welcome …

You are welcome to Chartered Institute of Taxation (Ghana) Established in 1980 the Chartered Institute of Taxation (Ghana) is the sole professional body mandated by ...

New York State and Local Sales and Use Tax ST-121 Exempt ...

Page 2 of 4 ST-121 (1/11) Part 2 — Services exempt from tax (exempt from all state and local sales and use taxes) Enter Certificate of Authority number here (if ...

Buyers’ Retail Sales Tax Exemption Certificate

REV 27 0032 (7/16/14) 1 BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE Not to be used to make purchases for resale Vendor/Seller Date Street Address City State …

Jobs in Ghana - Ghana Current & Latest Jobs, Job …

Cardno has Accounting job vacancies in Ghana to recruit Accountants. We are a professional infrastructure and environmental services company, with specialist ...

VAT - Ghana Revenue Authority

WHAT IS VAT? Value Added Tax (VAT) is a tax applied on the value added to goods and services at each stage in the production and distribution chain.

About Property Tax - sctax.org

Property Tax Information . How the Tax is Figured . Each class of property is assessed at a ratio unique to that type of property. The assessment ratio is applied to ...

E-595E Streamlined Sales and Use Tax Agreement Web …

Streamlined Sales and Use Tax Agreement Certificate of Exemption: Multistate Supplemental Name of purchaser State Reason for exemption Identification number (if …

GENERAL GUIDELINES FOR THE MANUFACTURING/R&D …

GENERAL GUIDELINES FOR THE MANUFACTURING/R&D PERSONAL PROPERTY TAX EXEMPTION IN MARYLAND Manufacturing/R&D Exemption State law authorizes …

Pennsylvania Exemption Certificate (REV-1220)

check one: pennsylvania tax unit exemption certificate (use for one transaction) pennsylvania tax blanket exemption certificate (use for multiple transactions)

Frequently Asked Questions - Sales Tax Taxability …

Sales Tax Taxability and Exemptions. What is the sales taxability of a leasing agreement? What is a domestic utility sales tax and how is it imposed?

- Last Product: raw minerals and mining in south africa

- Next Product: mineral processing case studies

RD Equipments

- gold mining in macalder

- list of all mines in south africa and contact number

- income statement format for mining company

- southern crushed minerals in gabes

- mining mobile crusher industry in india

- british coal mining company wales uk type

- latest coal mining news

- tissues on total quality control management in mining company

- mining fleet suppliers

- how to build mining equipment